×

Array

(

[fid] => 6980

[description] =>

[password] =>

[icon] =>

[redirect] =>

[attachextensions] =>

[creditspolicy] => Array

(

[post] => Array

(

[usecustom] => 1

[cycletype] => 1

[cycletime] => 0

[rewardnum] => 75

[extcredits1] => 0

[extcredits2] => 0

[extcredits3] => 0

[extcredits4] => 0

[extcredits5] => 0

[extcredits6] => 0

[extcredits7] => 0

[extcredits8] => 0

[rid] => 1

[fid] => 6980

[rulename] => 发表主题

[action] => post

[fids] => 32,52,67,447,1120,1151,1156,6750,6762,6763,6766,6769,6772,6773,6787,6796,6808,6809,6810,6813,6814,6820,6829,6830,6846,6856,6864,6865,6827,6930,6931,6776,6858,6880,6764,6932,6871,6758,6905,1116,6788,6812,6798,6736,6759,6842,6966,6767,6828,6924,6935,6936,6938,6940,6941,6826,6909,6803,6919,6911,6908,6881,6920,6912,6913,6921,6925,6922,6789,6818,6819,6872,6928,6969,6889,6888,6917,6939,6947,6961,6937,6943,6970,6869,6900,6902,6783,6817,1111,6870,6821,6951,6876,6952,6954,6960,6942,6910,6949,6962,6963,6964,6927,6926,6973,6728,6929,6874,6894,6896,6885,6857,6868,1113,6778,56,6844,6878,6802,6933,6811,6923,6877,6875,6918,6892,6757,6832,6833,6795,6793,6848,6837,6849,6850,6851,6852,6853,6854,6863,6882,6836,6790,6838,6794,6791,6873,555,6895,6934,6958,6944,6945,6907,6779,6886,6950,6904,6956,6862,6957,6855,6955,6959,6914,6965,6971,6972,6953,6975,6976,6799,6974,6824,6815,6891,6866,6979,6977,6765,6903,6948,6845,6879,1121,6980

)

[reply] => Array

(

[usecustom] => 1

[cycletype] => 4

[cycletime] => 0

[rewardnum] => 0

[extcredits1] => 0

[extcredits2] => 0

[extcredits3] => 0

[extcredits4] => 0

[extcredits5] => 0

[extcredits6] => 0

[extcredits7] => 0

[extcredits8] => 0

[rid] => 2

[fid] => 6980

[rulename] => 发表回复

[action] => reply

)

[digest] => Array

(

[usecustom] => 1

[cycletype] => 4

[cycletime] => 0

[rewardnum] => 0

[extcredits1] => 0

[extcredits2] => 0

[extcredits3] => 0

[extcredits4] => 0

[extcredits5] => 0

[extcredits6] => 0

[extcredits7] => 0

[extcredits8] => 0

[rid] => 3

[fid] => 6980

[rulename] => 加精华

[action] => digest

)

)

[formulaperm] => a:5:{i:0;s:0:"";i:1;s:0:"";s:7:"message";s:0:"";s:5:"medal";N;s:5:"users";s:0:"";}

[moderators] =>

[rules] =>

[threadtypes] => Array

(

[status] => 1

[required] => 0

[listable] => 0

[types] => Array

(

)

)

[threadsorts] => Array

(

)

[viewperm] =>

[postperm] =>

[replyperm] =>

[getattachperm] =>

[postattachperm] =>

[postimageperm] =>

[spviewperm] =>

[seotitle] =>

[keywords] =>

[seodescription] =>

[supe_pushsetting] =>

[modrecommend] => Array

(

[open] => 0

[num] => 10

[imagenum] => 0

[imagewidth] => 300

[imageheight] => 250

[maxlength] => 0

[cachelife] => 0

[dateline] => 0

)

[threadplugin] => Array

(

)

[replybg] =>

[extra] => a:2:{s:9:"namecolor";s:0:"";s:9:"iconwidth";s:0:"";}

[jointype] => 0

[gviewperm] => 0

[membernum] => 0

[dateline] => 0

[lastupdate] => 0

[activity] => 0

[founderuid] => 0

[foundername] =>

[banner] =>

[groupnum] => 0

[commentitem] =>

[relatedgroup] =>

[picstyle] => 0

[widthauto] => 0

[noantitheft] => 0

[noforumhidewater] => 0

[noforumrecommend] => 0

[livetid] => 0

[price] => 0

[fup] => 6974

[type] => sub

[name] => 币圈资讯

[status] => 1

[displayorder] => 0

[styleid] => 0

[threads] => 50922

[posts] => 50990

[todayposts] => 0

[yesterdayposts] => 0

[rank] => 60

[oldrank] => 61

[lastpost] => 2688723 美国2024年大选已花费147亿美元,或为史上最贵 1730688420 比推快讯

[domain] =>

[allowsmilies] => 1

[allowhtml] => 1

[allowbbcode] => 1

[allowimgcode] => 1

[allowmediacode] => 0

[allowanonymous] => 0

[allowpostspecial] => 1

[allowspecialonly] => 0

[allowappend] => 0

[alloweditrules] => 0

[allowfeed] => 0

[allowside] => 0

[recyclebin] => 1

[modnewposts] => 0

[jammer] => 0

[disablewatermark] => 0

[inheritedmod] => 0

[autoclose] => 0

[forumcolumns] => 0

[catforumcolumns] => 0

[threadcaches] => 0

[alloweditpost] => 1

[simple] => 16

[modworks] => 0

[allowglobalstick] => 1

[level] => 0

[commoncredits] => 0

[archive] => 0

[recommend] => 0

[favtimes] => 0

[sharetimes] => 0

[disablethumb] => 0

[disablecollect] => 0

[ismoderator] => 0

[threadtableid] => 0

[allowreply] =>

[allowpost] =>

[allowpostattach] =>

)

|

深度解析 Uniswap 和 SushiSwap 对 DAO 未来发展的影响

[复制链接]

|

当前离线

经验:

天策币:

活跃币:

策小分:

总在线: 分钟

本月在线: 分钟

|

|

|

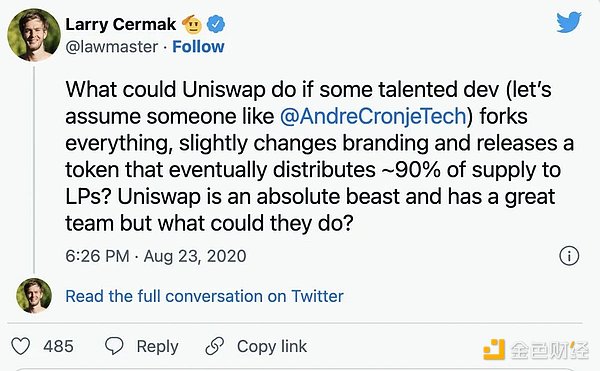

在加密领域,我们有一对重量级对决——Uniswap vs SushiSwap。这些DeFi协议一开始的源代码几乎完全相同,但后来在各自社区的指导下不断发展。它们不同的治理结构和过程构建了每个社区决定其底层协议未来的轨道。为了理解这些决策的影响,让我们深入研究一下这两个技术上类似的协议的治理历史和演变。 Uniswap和SushiSwap的简史大多数加密老手都熟悉Uniswap和SushiSwap的传奇故事。 那是2020年8月,DeFi Summer正如火如荼地进行着。6月,由Compound启动的DeFi协议终于解决了引导早期流动性的问题。此前,DeFi一直面临着激励问题——早期流动性提供者(LP)赚取的交易费很少,因为交易者会因高滑点而避开流动性不足的资金池。Compound向LP提供自己的治理代币,同时奖励早期用户并将协议控制权移交给社区,试图用这些方式来解决问题。这种激励设计引起了一场革命——早期的LP可以通过提高APY来为较小的资金池提供流动性,并对项目的未来拥有发言权,从中获得补偿。新的协议代币奖励迅速助燃了一波疯狂的流动性挖矿,使DeFi的TVL从6月的10亿美元增加到10月的150亿美元。 Uniswap享受到了DeFi新用户涌入带来的红利,其TVL从6月的7000万美元增长到8月底的3亿美元。这个开源协议是第一批使用自动做市(AMM)模式的交易所之一,在当年6月荣升到DEX的主导地位,并获得了顶级风投公司的大量支持。也许是由于新投资者的利益冲突,Uniswap没有发布治理代币,也没有改变其激励结构来应对新兴范式。这种不作为创造了一个机会,SushiSwap的匿名创始人Nomi很快就抓住了这个机会(巧合的是,就在几天前,The Block的研究主管发了下面的推文)。

Nomi 通过复制源代码并将其部署到以太坊上的新 Sushi 合约来分叉 Uniswap 以创建 SushiSwap。几乎相同的代码库,但拥有两个关键的新特性——治理代币和更新的质押奖励。在SushiSwap上,用户可以通过向池提供流动性来赚取其治理代币SUSHI。但最关键的是,这种流动性必须以Uniswap LP代币的形式出现。在大量Sushi奖励的激励下(前两周内每个区块获得1000个奖励!),用户争相前往Uniswap,将资产存入符合条件的池中,以换取Uniswap LP代币,并迅速将这些代币投入SushiSwap合约中。Uniswap的TVL从3亿美元迅速增长到18亿美元。 上线两周后,SushiSwap启动了流动性迁移,将所有 Uniswap LP 代币转移到 SushiSwap 上,在Uniswap上兑换相应的代币对,并使用代币来初始化新的SushiSwap流动性池。当迁移结束时,SushiSwap已经获得了价值8.1亿美元的代币,约占Uniswap流动性的55%。 流动性虹吸——现在被称为“吸血鬼攻击”——是DeFi的一个里程碑式事件,它强调了社区协议激励协调和社区拥有治理的重要性。这一事件给各个领域的项目都带来了压力,该事件要求它们引入治理代币,并将其协议的控制权交给社区。同年9月,Uniswap发布了自己的治理代币UNI,以增强社区参与度。 今天,Uniswap和SushiSwap仍然受到各自社区的指导。激励措施的调整、新产品的推出、合作伙伴关系和其他发展都由社区提出、投票和执行。尽管它们最初在技术上有相似之处,但这两个社区发展了不同的治理方式,使它们能够以去中心化的方式实现目标。 早期治理在项目启动几周后,SushiSwap立即尝试了去中心化管理,但结果并不顺利。在迁移的前一天,Nomi带着1300万美元的开发资金潜逃,在不到一周后就将其归还,并把项目密钥交给了FTX的创始人萨姆 |

|

|

|

|

|

|

|

|

|