×

Array

(

[fid] => 6980

[description] =>

[password] =>

[icon] =>

[redirect] =>

[attachextensions] =>

[creditspolicy] => Array

(

[post] => Array

(

[usecustom] => 1

[cycletype] => 1

[cycletime] => 0

[rewardnum] => 75

[extcredits1] => 0

[extcredits2] => 0

[extcredits3] => 0

[extcredits4] => 0

[extcredits5] => 0

[extcredits6] => 0

[extcredits7] => 0

[extcredits8] => 0

[rid] => 1

[fid] => 6980

[rulename] => 发表主题

[action] => post

[fids] => 32,52,67,447,1120,1151,1156,6750,6762,6763,6766,6769,6772,6773,6787,6796,6808,6809,6810,6813,6814,6820,6829,6830,6846,6856,6864,6865,6827,6930,6931,6776,6858,6880,6764,6932,6871,6758,6905,1116,6788,6812,6798,6736,6759,6842,6966,6767,6828,6924,6935,6936,6938,6940,6941,6826,6909,6803,6919,6911,6908,6881,6920,6912,6913,6921,6925,6922,6789,6818,6819,6872,6928,6969,6889,6888,6917,6939,6947,6961,6937,6943,6970,6869,6900,6902,6783,6817,1111,6870,6821,6951,6876,6952,6954,6960,6942,6910,6949,6962,6963,6964,6927,6926,6973,6728,6929,6874,6894,6896,6885,6857,6868,1113,6778,56,6844,6878,6802,6933,6811,6923,6877,6875,6918,6892,6757,6832,6833,6795,6793,6848,6837,6849,6850,6851,6852,6853,6854,6863,6882,6836,6790,6838,6794,6791,6873,555,6895,6934,6958,6944,6945,6907,6779,6886,6950,6904,6956,6862,6957,6855,6955,6959,6914,6965,6971,6972,6953,6975,6976,6799,6974,6824,6815,6891,6866,6979,6977,6765,6903,6948,6845,6879,1121,6980

)

[reply] => Array

(

[usecustom] => 1

[cycletype] => 4

[cycletime] => 0

[rewardnum] => 0

[extcredits1] => 0

[extcredits2] => 0

[extcredits3] => 0

[extcredits4] => 0

[extcredits5] => 0

[extcredits6] => 0

[extcredits7] => 0

[extcredits8] => 0

[rid] => 2

[fid] => 6980

[rulename] => 发表回复

[action] => reply

)

[digest] => Array

(

[usecustom] => 1

[cycletype] => 4

[cycletime] => 0

[rewardnum] => 0

[extcredits1] => 0

[extcredits2] => 0

[extcredits3] => 0

[extcredits4] => 0

[extcredits5] => 0

[extcredits6] => 0

[extcredits7] => 0

[extcredits8] => 0

[rid] => 3

[fid] => 6980

[rulename] => 加精华

[action] => digest

)

)

[formulaperm] => a:5:{i:0;s:0:"";i:1;s:0:"";s:7:"message";s:0:"";s:5:"medal";N;s:5:"users";s:0:"";}

[moderators] =>

[rules] =>

[threadtypes] => Array

(

[status] => 1

[required] => 0

[listable] => 0

[types] => Array

(

)

)

[threadsorts] => Array

(

)

[viewperm] =>

[postperm] =>

[replyperm] =>

[getattachperm] =>

[postattachperm] =>

[postimageperm] =>

[spviewperm] =>

[seotitle] =>

[keywords] =>

[seodescription] =>

[supe_pushsetting] =>

[modrecommend] => Array

(

[open] => 0

[num] => 10

[imagenum] => 0

[imagewidth] => 300

[imageheight] => 250

[maxlength] => 0

[cachelife] => 0

[dateline] => 0

)

[threadplugin] => Array

(

)

[replybg] =>

[extra] => a:2:{s:9:"namecolor";s:0:"";s:9:"iconwidth";s:0:"";}

[jointype] => 0

[gviewperm] => 0

[membernum] => 0

[dateline] => 0

[lastupdate] => 0

[activity] => 0

[founderuid] => 0

[foundername] =>

[banner] =>

[groupnum] => 0

[commentitem] =>

[relatedgroup] =>

[picstyle] => 0

[widthauto] => 0

[noantitheft] => 0

[noforumhidewater] => 0

[noforumrecommend] => 0

[livetid] => 0

[price] => 0

[fup] => 6974

[type] => sub

[name] => 币圈资讯

[status] => 1

[displayorder] => 0

[styleid] => 0

[threads] => 50922

[posts] => 50990

[todayposts] => 0

[yesterdayposts] => 0

[rank] => 59

[oldrank] => 59

[lastpost] => 2688723 美国2024年大选已花费147亿美元,或为史上最贵 1730688420 比推快讯

[domain] =>

[allowsmilies] => 1

[allowhtml] => 1

[allowbbcode] => 1

[allowimgcode] => 1

[allowmediacode] => 0

[allowanonymous] => 0

[allowpostspecial] => 1

[allowspecialonly] => 0

[allowappend] => 0

[alloweditrules] => 0

[allowfeed] => 0

[allowside] => 0

[recyclebin] => 1

[modnewposts] => 0

[jammer] => 0

[disablewatermark] => 0

[inheritedmod] => 0

[autoclose] => 0

[forumcolumns] => 0

[catforumcolumns] => 0

[threadcaches] => 0

[alloweditpost] => 1

[simple] => 16

[modworks] => 0

[allowglobalstick] => 1

[level] => 0

[commoncredits] => 0

[archive] => 0

[recommend] => 0

[favtimes] => 0

[sharetimes] => 0

[disablethumb] => 0

[disablecollect] => 0

[ismoderator] => 0

[threadtableid] => 0

[allowreply] =>

[allowpost] =>

[allowpostattach] =>

)

当前离线

经验:

天策币:

活跃币:

策小分:

总在线: 分钟

本月在线: 分钟

|

|

|

关于“即将到来的市场厄运”的线索我们最近开始在这次反弹期间在波动空间中看到令人担忧的迹象。值得注意的是,对冲指数波动一直是这一普遍下跌趋势中最具支撑性的因素之一。

世界上大部分地区都在机构层面进行了良好的对冲,而 vol 市场供过于求。夏季是一个有趣的时期:低流动性 + 供应充足的成交量 = 指数水平的均值回归和成交量压缩,现在即将结束。

现在,随着市场一直在上涨,我们已经开始看到隐含波动率 (IV) 在固定执行权的基础上增加,揭示了这个支撑指数波动率,我预计我们走得越高,这种波动率就会继续上升。

这很重要,因为我们已经看到债券(MOVE 指数)和外汇等其他领域的风险溢价突破,而我们现在才看到股票领域发生这种情况的线索。

请记住,市场不会坚持亏损交易,尤其是在您预期获利的下跌市场中;由于表现不佳,在这次低迷时期的大部分看跌期权都被货币化了,而 vol long 也被淘汰了。

因此,最近的期权周期集中在解开这些交易和做空交易量上。我们已经从创纪录的偏斜变成了创纪录的平偏:实体一直在出售 vol/skew,而且它一直在盈利。当这种情况发生时,你可能会得到一个有意义的 vol 事件。

换句话说,股市基本上被两件事所牵制:看跌头寸/情绪和指数波动对冲。我们现在看到越来越多的经销商头寸不是过度对冲,而是同等对冲。

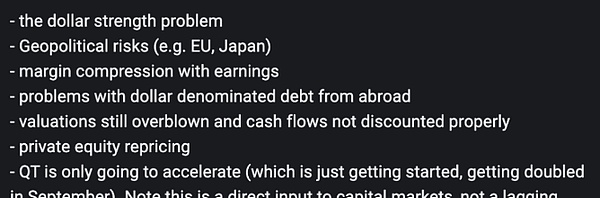

随着您在空头头寸之外挤压实体,并且在客户层面上对冲的交易量减少,市场可以开始对下面列出的核心宏观因素做出反应,这些因素在很大程度上尚未被消化:

这并不是说不可能发生反弹,但这里发生的反弹实际上是看跌的,并打开了另一个更波动的下跌行情,因为它会破坏指数波动率对冲。此外,还要注意歪斜。

更高的偏斜意味着更肥的左尾,以及在进一步抛售中更高水平的隐含波动率的可能性更高。如果倾斜变陡且成交量变得供不应求,交易商将不会像以往那样提供支持性资金流,反而会加剧走势。

这也不是说市场即将崩溃,而是那个窗口现在正在打开。考虑到经销商定位的变化,存在更高的风险和更肥的尾巴。本月可能不会取消固定,但几率正在增加。

这是一个 5 周的周期,来自经销商的股票回购自然是空头看跌/多头看涨 (vanna/charm),速度很慢。如果你还记得,它在上周或两周内大力支持市场,并结合 vol 压缩循环。

没有一个熊市直接下跌。市场需要比其参与者更多的流动性和耐心,因此波动很大。不要中间弯曲这个。客观上看起来像扯淡,你的风险资产还没有触底。

希望这篇文章对大家有一定的帮助。 来源:金色财经 |

|

|

|

|

|

|

|

|

|